-

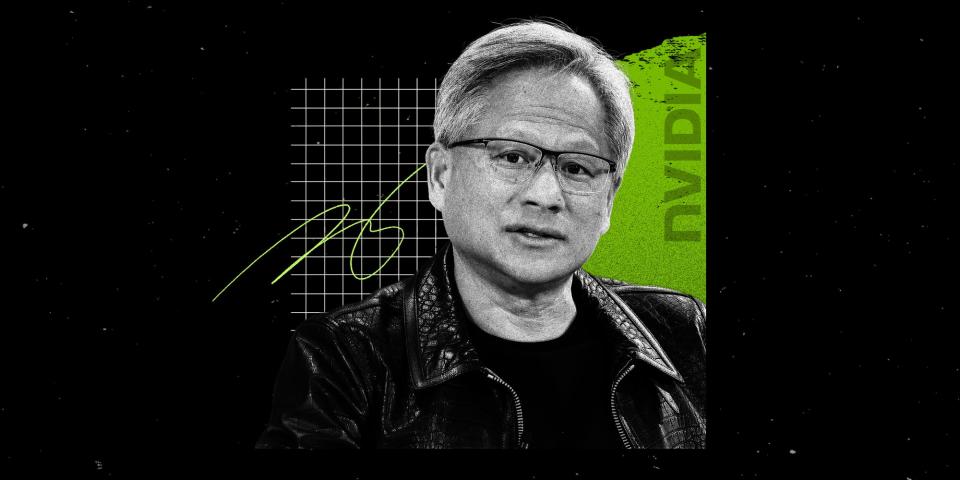

Nvidia is on monitor to hit a $10 trillion valuation, analyst Beth Kindig says.

-

Kindig is forecasting robust development and “fireworks” for the inventory after its Blackwell launch.

-

Jensen Huang assured traders on Nvidia’s next-gen AI chip, promising “billions” in income.

Nvidia is on monitor to greater than triple in worth, in keeping with Beth Kindig, the lead tech analyst at I/O Fund.

Chatting with Yahoo Finance on Thursday, Kindig mentioned she foresees Nvidia notching a $10 trillion valuation over the long run. That means monster beneficial properties for the $2.9 trillion AI titan, largely as a result of robust anticipated development and beneficial properties from its next-generation AI chip, dubbed Blackwell, Kindig mentioned.

Traders on Wall Road have grown involved that Nvidia is turning into overvalued, given its large run-up over the previous yr and traders’ huge expectations for earnings development. Nvidia shares fell as far more than 6% Thursday after the corporate beat earnings for the second quarter, albeit extra narrowly than earlier quarters.

Traders even have issues about Nvidia’s Blackwell chip after business analysts reported that the chip’s launch can be postponed by two to a few months as a result of “main points in reaching excessive manufacturing quantity.”

Kindig argues that Nvidia’s outcomes had been nonetheless “nice,” and sufficient to brush off traders’ issues heading into the outcomes.

Nvidia CEO Jensen Huang defended the progress on Blackwell in a current interview with Bloomberg, revealing that the corporate made a “mass change to enhance yield” and was trying to pull in “billions of {dollars}” in income from the next-gen chip.

“That is why issues are being revised up they usually had been by no means revised down,” Kindig mentioned of Nvidia estimates, including that she remained optimistic on Blackwell’s upcoming launch. “They’re saying Blackwell is principally on time. Blackwell is just not a priority. If something, it is extraordinarily bullish.”

Kindig predicted that Nvidia’s development trajectory ought to change into extra obvious as soon as Wall Road analysts upwardly revise fiscal estimates for the next yr. That needs to be a “large second” for Nvidia, adopted by the discharge of transport quantity figures for Blackwell in 2025.

“That is going to be fireworks, is how I’d put it. Absolute, final fireworks for Blackwell will are available Q1, with that Q2 information,” Kindig mentioned. “Early subsequent yr might be fireworks once more for Nvidia, and we might be on monitor for that $10 trillion.”

Kindig’s forecast for the chip firm is among the many most bullish, although Wall Road remains to be feeling optimistic concerning the chipmaker. Analysts have issued a mean worth goal of $151 per share, per Nasdaq knowledge, implying one other 27% upside for the inventory over the following 12 months.

Learn the unique article on Enterprise Insider